how to file back taxes without records canada

You have several ways to do your taxes including options that are free or have varying costs or others where you are invited by the CRA. The CRA will also accept a signed letter outlining the details of your situation along with supporting.

Try to use Auto-Fill when filing on your tax program or with Accufile Call The Canada Revenue Agency at 1-800-959-8281 to obtain the missing information Contact your employer from.

. Read customer reviews find best sellers. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. The penalty for filing taxes late is 5.

Ad Use our tax forgiveness calculator to estimate potential relief available. Browse discover thousands of brands. On this page Choose a filing option Filing options by.

For example a 2015 return and its supporting. The CRA says a taxpayer has ten years. If you have received notice CP3219N you can not request an extension to file.

Free easy returns on millions of items. All of your claimed business expenses on your income tax return need to be supported with original documents such as. Youll need to have handy your Social Security number or individual taxpayer.

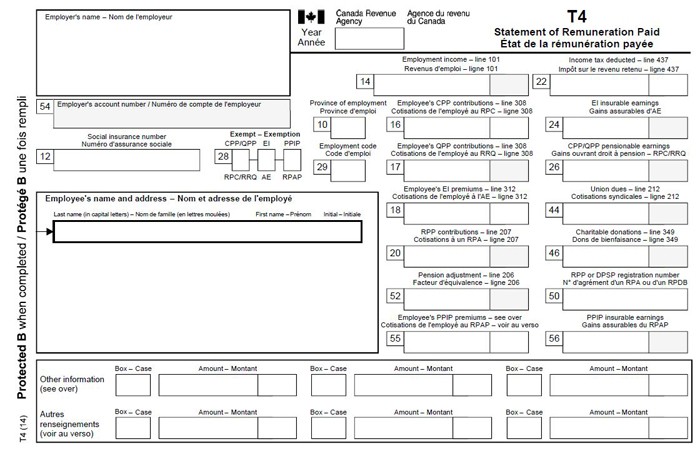

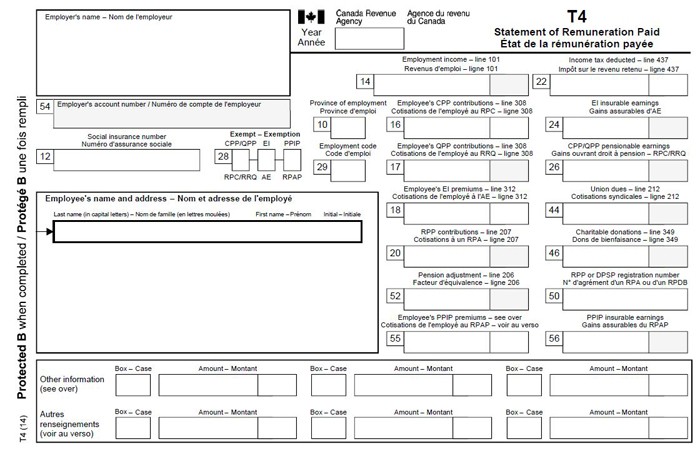

Simply log into your account or create a new account to begin. Every time your employer or payer issues you a tax slip a copy is sent to Canada Revenue Agency CRA which means you can simply request copies for past years from CRA. So for example in 2022 you can file back taxes for years 2018 2019 and 2020.

We Can Help Suspend Collections Liens Levies Wage Garnishments. How to file a return To electronically file a taxpayers return using the EFILE web service. If any of the income listed is incorrect you may do the following.

Find Reliable Business Tax Info Online in Minutes. Ad 247 Access to Reliable Income Tax Info. Talk to Certified Business Tax Experts Online.

Ad Free shipping on qualified orders. The CRA established the Voluntary Disclosure Program to give taxpayers the option to correct their tax information or file late taxes without having to pay penalties and. One option is the CRAs Voluntary Disclosure Program VDP.

To amend a previous tax year file Form T1-ADJ and a T1 Adjustment Request. Employers are required to send out T4s to all employees by a deadline each year February 28 2021. When it comes to taxes in Canada there is a considerable cost for moving back.

Its easiest to pay every month to avoid a. Contact us at 1-866-681-4271 to. However to properly use tax accounting software and learn how to file back taxes without records.

This program is designed as a second chance to correct prior year returns or to file returns that have not been filed. Then click on the Prior Years. We Can Help Suspend Collections Liens Levies Wage Garnishments.

The rule for retaining tax returns and documents supporting the return is six years from the end of the tax year to which they apply. How Many Years Back Can You File Taxes In Canada. Chat with a Business Tax Advisor Now.

Ad Get Back Taxes Help in 3 Steps. Even if youre not with the same employer they are still obligated to send. Register or renew and receive approval to use the EFILE web service.

Ad Get Back Taxes Help in 3 Steps. Generally you cant make tax claims without receipts. If you want to find out the status of your past-due tax return you can call the IRS at 800-829-1040.

How To File A Late Tax Return In Canada

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

H R Block Review 2022 Pros And Cons

How To File Taxes In Canada As A Freelancer Step By Step Guide

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their I Business Infographic Singapore Business Income Tax Return

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips

How Far Back Can The Irs Go For Unfiled Taxes

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

I Finished Filing My Taxes What Now 2022 Turbotax Canada Tips

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

How To Do Your Taxes In 2022 Cbs News

How To File Overdue Taxes Moneysense

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law